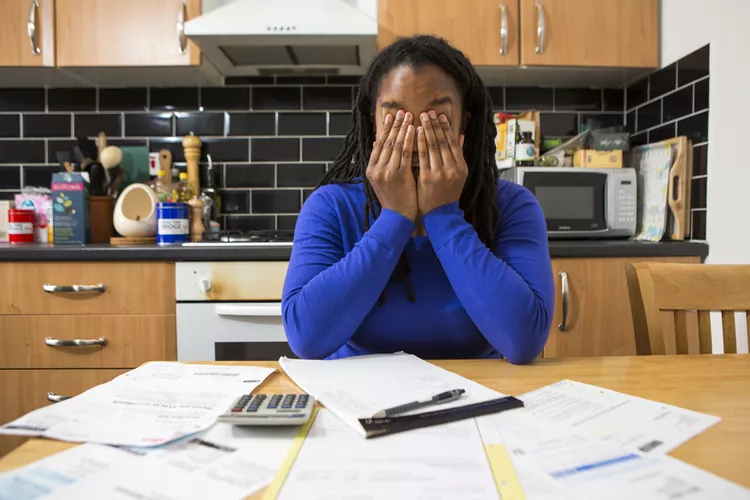

Smart Steps to Take When You’re in Debt Trouble

By Steve | AWayOutOfDebt.com If you’re staring at a pile of credit card debt right now, you’re not alone—and you’re not out of options. According to recent reports, unpaid credit card balances are on the rise, and many households have been carrying this debt for more than a year. Let me be the first to […]

Trinity Debt Management: The Real Deal, the Fine Print, and Whether It’s Right for You

Thinking about Trinity Debt Management? Here’s what to expect, what to watch out for, and why it might not be the magic fix you think it is.

Why You’re Still Broke: How Overspending Can Sink Even a Six-Figure Salary

Let’s start with a cold, hard truth: income alone doesn’t make you rich.In fact, a spending problem can completely wipe out the benefits of a high income. That’s not a theory—it’s a pattern that repeats across every income bracket, from recent college grads to professional athletes and Hollywood stars. If your expenses grow as fast […]

50% of Parents Are Financially Supporting Adult Kids — Here’s What It’s Costing Them

By Steve | AWayOutOfDebt.com Let’s talk about something that might feel a little too real if you’re a parent with grown kids… or a grown kid trying to make it on your own. According to a new report from Savings.com, half of all parents with adult children are now providing them with financial support. That’s […]

What Could Happen to Your Student Loans If the Department of Education Is Dismantled?

A Big Shakeup in Washington — and What It Means for Borrowers President Donald Trump just signed an executive order aimed at dismantling the U.S. Department of Education — and it’s raising serious questions for the 40+ million Americans with federal student loans. While only Congress can officially eliminate the Department of Education, the Trump […]

The Life-Changing Benefits of Being Debt-Free

“Formal education will make you a living; self-education will make you a fortune.” – Jim Rohn Debt is a thief. It steals your freedom, your options, and your peace of mind. But what if you could take it all back? What if you could wake up every morning knowing that your income is yours to keep, that […]

10 Best Side Hustles to Pay Off Debt in 2025

Getting out of debt can feel like an uphill battle, but the right side hustle can accelerate your progress and help you achieve financial freedom faster. Whether you need an extra $200 a month or $2,000, these side hustles for 2025 can supercharge your debt payoff strategy. Plus, many of them can be done from […]

How to Slash Your Expenses Without Feeling Miserable

Cut Costs, Keep Your Sanity, and Take Control of Your Finances Let’s be honest—when people hear “cut expenses,” they imagine a miserable, joyless life of sacrificing everything they love. 🚫 No eating out.🚫 No fun.🚫 Just suffering your way to financial freedom. That’s the wrong way to look at it. The truth is, cutting expenses isn’t about restriction—it’s about optimization. […]

How a Home-Based Side Hustle Saves You Thousands in Taxes

Starting a home-based side hustle isn’t just a great way to pay off debt and build financial security—it can also unlock huge tax savings that traditional employees don’t get. By leveraging the right deductions, you can keep more of your earnings, reinvest in your business, and accelerate your path to financial freedom. In this article, we’ll break […]

Why Your Mindset Matters More Than Your Budget

A Inspired Guide to Winning with Money 📣 “You don’t have to be great to start, but you have to start to be great.” That’s true in life, in business, and—yes—in your finances. If you want to get out of debt, build wealth, and create a future that excites you, you’ve got to understand one simple […]